Agriculture, home textile show the export diversification way

The two potential sectors have registered strong export growth in the fiscal 2020-21

Agriculture and home textile products have come up as promising forex earners in this pandemic time to fit the bill in giving Bangladesh an edge over its competitors in the world of exports.

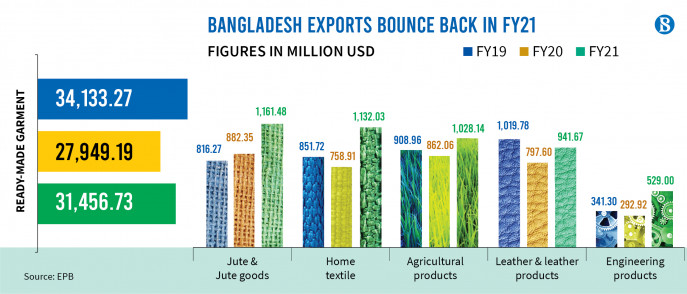

The two potential sectors have registered strong export growth in the fiscal 2020-21, clocking a $1 billion mark for the first time. Jute and jute goods also earned over $1 billion after 2018.

In the last fiscal year, earnings from home textile items grew by 49.17% year-on-year to reach $1.13 billion and agricultural products earned $1.02 billion. The receipts from jute and jute goods shipments amounted to $1.16 billion, according to the Export Promotion Bureau (EPB) data published on Monday.

The country is on the path of returning to normalcy after a pandemic-hit period, with its exports raking in $38.75 billion in FY21, recording a growth rate of 15.10%. The growth is riding on RMG export recovery, which earned $31.45 billion showing a 12.55% growth, according to the EPB.

However, the total export receipts in FY21 was 5.47% below the annual target of $41 billion. In FY20, the figure stood at $33.67 billion, according to the EPB. The export earnings were also lower than $40.53 billion in the pre-pandemic FY19.

Among other major sectors, frozen and live fish exports saw 4.65% growth to $477.37 million, which was $456 million in Fy20.

Earnings from the pharmaceutical sector experienced a 24.47% jump to $169 million, while plastic goods earnings increased by 14.68% to $115.28 million.

The specialised textile sector registered 12.81% growth to $131 million.

In June alone in FY21, the export earnings showed significant growth.

The earnings from merchandise shipments grew by 31.77% to $3.57 billion from $2.71 billion year-on-year, which was also 2.52 % below the target of $3.67 billion.

Apparel shipments registered a 12.55 % year-on-year growth to hit $31.45 billion even during the pandemic. Despite the double-digit growth, the figure was still 6.89 % below the annual target of $33.78 billion.

Of the total earnings from the garment shipments, knitwear items fetched $16.96 billion, registering a strong 21.94% year-on-year growth. Woven, which was in the negative territory over the last one and a half years, also posted a 3.24 % positive growth to reach $14.49 billion at the end of the last fiscal year.

Exporters say the overall apparel export is very close to a complete rebound on the back of the recoveries of the European Union and the US markets.

Rashed Mosharraf, executive director (marketing) of Zaber & Zubair Fabrics Ltd, said, "We are experiencing an organic growth of 10% on average in the home textile export each year."

He mentioned that the sector also enjoyed good growth during the Covid-19 lockdown as people stayed at home and home textile consumption also went high.

Fazlee Shamim Ehsan, vice-president of the Bangladesh Knitwear Manufacturers and Exporters Association, said the demand for both knitwear and home textile items has soared globally as people have been staying at home for a long time due to lockdowns amid the pandemic, he added.

Despite the recovery sign, skilled manpower shortage, price hike of raw materials and Covid-19 uncertainty remain as challenges for the industry.

Apex Footwear Ltd Managing Director Syed Nasim Manzur said, "Leather and footwear consumers in two the US and the UK have resumed their pent-up spending after regaining confidence following the rollout of vaccination in those countries."

The USA has experienced about a 27% hike in consumer spending last month, which is the largest export market for Bangladesh's leather footwear, once the EU held that position.

Italy and China, two other major destinations for Bangladeshi leather, resumed their factories over the last few months.

"China is also souring a good quantity of leather goods from us as its domestic market also has a big demand," he added.

Mahmudul Haq, immediate past chief executive officer of Janata Jute Mills, said, "We have experienced good growth in the fiscal 2020-21 on the back of a rise in prices of raw materials, but our export volume dropped slightly."

He said their products lost some markets in the last fiscal year, which will affect Janata Jute's exports earnings this year when prices of raw jute will come down.

Turkey has already innovated regenerated and synthetic cotton as the replacement of jute yarn. Synthetic bags are also replacing jute bags. It is an alarming sign for exports, Mahmudul said.

Commenting on the export growth, Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), told The Business Standard that during the pandemic it is a very good performance, all credit goes to the government's initiative to allow factories to operate amid Covid-19 complying with health protocols, and workers who worked hard for shipping goods on time.

Faruque hoped the overall exports will be better by October this year as major export markets have already rolled out vaccination.

The BGMEA president said the apparel sector's contribution to export earnings has come down to 81%, which was about 84% during the pre-Covid period. But it is also good news that sectors such as agriculture, home textile and jute and jute goods have posted strong growth, leading the way to the country's export diversification.

Pran Foods

Pran Foods